Have a reverse mortgage? Camarotti Homes buys homes as-is for cash—no repairs, no stress, even with a reverse mortgage in place.

Do you want to sell your home fast, but are worried your reverse mortgage might stop you? Here’s what you should know about selling a home with a reverse mortgage.

A reverse mortgage is a special loan. It’s for homeowners, usually age 62 and older. Instead of making payments to the bank like a normal loan, the bank pays you. You’re using the equity in your home to get cash.

You can get this money in three ways:

Many people use this money for things like medical bills, home repairs, or everyday costs. The amount you get depends on your age and how much equity you have in the home.

As time goes on, the amount you owe grows because interest adds up. You don’t pay it back until one of the following happens:

You can sell a house even if it has a reverse mortgage. Your lender cannot make you sell, but you have the right to sell your home whenever you want.

When you decide to sell, you must pay off the reverse mortgage. This means paying the loan balance plus any interest and fees. If your home’s value has gone up, and you sell it for more than what you owe, you get to keep the extra money.

But if your home’s value has gone down, you might owe more than the house is worth. Selling a home with a reverse mortgage, in this case, can be a little more complicated. If the home sells for its appraised value, the lender gets the sale money, and mortgage insurance covers the rest.

If you pass away, your heirs may need to sell the home to pay off the reverse mortgage. They will not owe more than the home’s value, even if the loan is higher. This rule applies if you have a Home Equity Conversion Mortgage (HECM), which is the most common reverse mortgage. HECMs are backed by the Federal Housing Administration (FHA). Some private lenders have their own types of reverse mortgages with different rules.

Selling a home with a reverse mortgage is definitely possible, but there are some key points you should know before you start.

When you sell your home, you must pay back the full amount you owe on your reverse mortgage. This includes the original loan, plus any interest and fees that have added up over time. The loan becomes due once the home is sold, so you need to plan for this repayment. If your home is worth more than what you owe, you get to keep the extra money after paying off the loan.

One of the important protections of a government-backed reverse mortgage (called a Home Equity Conversion Mortgage or HECM) is that you or your heirs will never owe more than the home’s value when it sells. This means if the loan balance is higher than the sale price, you won’t have to pay the difference out of pocket. Mortgage insurance covers the shortfall. This protection only applies to HECMs, which make up most reverse mortgages.

Usually, there are no penalties for selling your home with a reverse mortgage. However, it’s very important to check your loan agreement carefully. Some loans might have specific fees or conditions when you sell. Always ask your lender for a written payoff statement that shows exactly how much you owe, including any fees. This helps you avoid surprises at closing.

Because you borrow against your home’s equity with a reverse mortgage, the amount you owe grows over time. This means you may have less equity left when you sell. If your home’s value has gone down, the sale might not cover the full loan balance. But thanks to the non-recourse rule, you won’t owe more than the home’s worth. Still, this can affect how much money you get from the sale.

If you make a big profit from selling your home, you might have to pay capital gains tax. However, most people don’t owe this tax unless their profit is over $250,000 (or $500,000 for married couples). It’s a good idea to talk to a tax professional to understand if this applies to you.

When selling your home, remember that closing costs will reduce your final proceeds. These costs include real estate agent commissions, title insurance, and other fees related to the sale. Make sure to factor these into your financial planning so you know what to expect after paying off the reverse mortgage.

If your house needs repairs or updates, you might worry that you’ll have to spend a lot of money before you can sell. But here’s the good news: you can sell your home as-is. This means you don’t have to fix anything or clean up, just sell it in its current condition.

Selling as-is is a great option if:

When you sell your home as-is, you can avoid the hassle of showings, open houses, and picky buyers. You also don’t have to worry about the buyer’s financing falling through because of inspection issues. Many cash home buyers, like us at Camarotti Homes, buy homes as-is and close quickly.

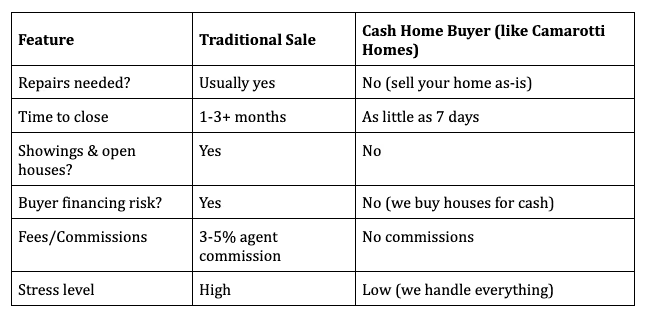

When you’re selling a home with a reverse mortgage, you have two main options: sell the traditional way with a real estate agent, or sell to a cash home buyer.

Here’s a quick comparison:

If you want to sell your home fast, avoid repairs, and skip the stress, selling to a cash home buyer is surely the best choice. We buy ugly houses, and we buy houses for cash, so you don’t have to worry about anything.

If you want to sell your home in Florida, we’re here to help. At Camarotti Homes, we make it easy to sell your home in Florida-even if you have a reverse mortgage. We buy houses for cash, and we buy ugly houses, so you can sell your home as-is, without any repairs or cleaning. Our expert team will walk you through every step, answer all your questions, and handle the paperwork for you.

Ready to make a life-changing decision? Contact us today to sell your home fast to Camarotti Homes!

No effort needed, no hidden fees. Receive cash and a fresh start in as little as 7 days.